The crypto market is buzzing once again. Bitcoin, the world’s largest digital asset, has been showing signs of renewed momentum—sparking the question on every investor’s mind: Is a new bull cycle officially beginning?

With price swings turning upward, on-chain activity heating up, and institutions appearing hungrier than ever, experts say the next major rally may already be quietly unfolding behind the scenes.

But what are the key indicators that reveal whether Bitcoin is entering a fresh bull cycle? And more importantly—what do these signals mean for traders watching from the sidelines?

Let’s take a deep, data-backed dive into the metrics shaping Bitcoin’s next big move.

1. The Hash Rate Hits All-Time Highs: Confidence from Miners

If Bitcoin miners are the backbone of the network, the hash rate is the heartbeat—and right now, that heart is pounding harder than ever.

Why It Matters:

- A rising hash rate shows miners are investing more computing power.

- Miners rarely make emotional decisions—they spend millions on hardware only when long-term expectations are bullish.

- Historically, every major Bitcoin bull run has been preceded by significant hash rate growth.

Even during market pullbacks, miners continue expanding operations. This resilience signals strong faith in long-term price appreciation. Simply put: miners don’t expand unless they expect rewards to grow.

A record-breaking hash rate often marks the early phase of a bull market, even before the public catches on.

2. Long-Term Holders Are Accumulating Again

One of the most reliable Bitcoin indicators isn’t flashy. It isn’t technical. It’s behavioral.

Long-term holders—those who haven’t moved their coins in over a year—are steadily accumulating.

This group includes whales, institutional investors, and seasoned early adopters. When they buy quietly and consistently, it usually marks the smart-money phase of a bull cycle.

Key Signals:

- Shrinking supply on exchanges

- Increasing “HODL waves” (coins dormant > 1 year)

- Whales moving BTC from trading accounts to cold storage

This behavior shows confidence. Long-term holders aren’t buying to flip—they’re buying to wait for the next major price surge.

And historically? Bull runs begin when long-term holders tighten supply and new demand starts to rise.

3. On-Chain Activity Is Surging: A Classic Bull Signal

Blockchains don’t lie. When activity heats up, something big is brewing.

Recent on-chain data reveals:

- Rising number of daily active addresses

- More large-value transactions

- Increased network fees (a demand-driven metric)

- Surge in new wallets entering the ecosystem

This kind of activity typically occurs during early bull phases, when adoption starts rising again.

Think of it as Bitcoin waking up from hibernation:

More people are transacting. More money is moving. More entities are returning to the network.

This is rarely a coincidence. It’s often the first spark before a major rally ignites.

4. Supply Shock Incoming: The Effect of Reduced Exchange Balances

Bitcoin’s supply dynamics are unlike any other asset. Only 21 million coins will ever exist, and many of those are already in long-term hands.

Now add another important metric:

Bitcoin held on exchanges has been dropping to multi-year lows.

Why It’s Crucial:

When less Bitcoin is available on exchanges, liquidity tightens. This means any sudden demand can cause a rapid price increase—the classic setup for explosive bull runs.

Supply shock + growing demand = the fuel of Bitcoin bull cycles.

This trend is incredibly bullish because it suggests investors are storing Bitcoin, not selling it. And scarcity is Bitcoin’s strongest weapon.

5. Institutional Interest Is Quietly Ramping Up

The last bull run was fueled by retail excitement. This time, institutions may be the spark.

What’s driving institutional interest now?

- Bitcoin ETFs and derivatives markets expanding

- Hedge funds allocating a percentage to BTC for diversification

- Insurance companies and pension funds exploring exposure

- Corporations holding Bitcoin in their treasury

These institutions don’t trade emotionally—they trade strategically. Their involvement brings legitimacy, liquidity, and long-term stability.

When institutional demand spikes, bull cycles often follow.

After all, when big money moves, markets move.

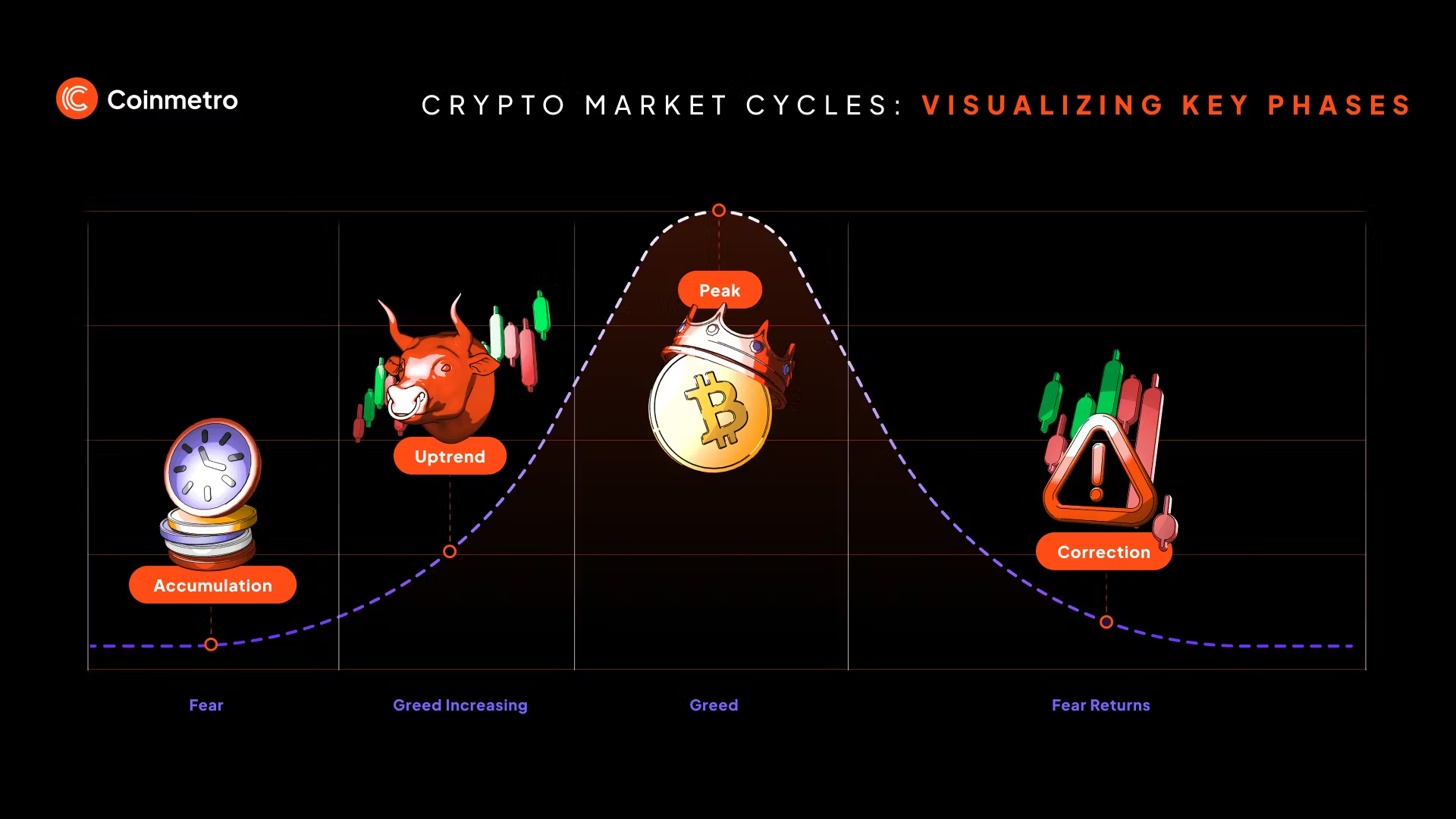

6. Market Sentiment Is Turning Greener: Fear Fading, Greed Rising

Crypto sentiment indicators—like the Bitcoin Fear & Greed Index—offer an emotional snapshot of the market.

And right now, sentiment is steadily transitioning from fear to neutral and—slowly—into greed, a pattern historically seen before bullish momentum.

Why Sentiment Matters:

Emotions drive markets.

Fear creates bottoms. Greed creates tops.

But transitions between them spark rallies.

Whenever sentiment shifts from fear to optimism, Bitcoin tends to begin forming a bullish structure—the early stage of a bull cycle’s upward curve.

7. Technical Indicators Are Flashing “Bullish Reversal”

Even traders who rely solely on charts are starting to spot something interesting:

Bitcoin’s technical indicators are aligning with the start of a new uptrend.

Key Technical Indicators:

- 50-day MA crossing above the 200-day MA (Golden Cross)

- Higher lows forming—a clear sign of bullish structure

- Breakouts from long-term resistance levels

- Rising RSI without hitting overbought zones

When multiple indicators line up, analysts take notice.

Chart patterns don’t guarantee a bull run—but they speak volumes when combined with on-chain and macro data.

8. Macro Conditions Are Becoming Bitcoin-Friendly

Bitcoin doesn’t exist in a vacuum. Global economic trends influence its direction.

Favorable Macro Forces Include:

- Lower interest rate expectations

- Reduced inflation pressure

- Growing distrust in traditional banking

- Currency instability in several regions

In times of global financial uncertainty, Bitcoin becomes more attractive as a hedge, a store of value, and a borderless asset.

Each macro shift adds more fuel to potential upward momentum.

So… Is Bitcoin Really Entering a New Bull Cycle?

All signs point toward one powerful truth:

Bitcoin is building the foundation of its next major bull run.

But here’s the twist—bull cycles don’t begin with fireworks.

They begin quietly.

They begin subtly.

They begin exactly like this.

Before prices hit headlines, before retail investors rush in, before the world starts talking again—the early indicators emerge.

And right now, almost every major indicator is blinking green.

The ingredients are here:

- Hash rate at all-time highs

- Long-term holders accumulating

- Increasing institutional interest

- Shrinking supply on exchanges

- Rising on-chain activity

- Favorable macro trends

- Bullish technical patterns

This combination has preceded every historical Bitcoin bull cycle.

Does that guarantee one? No market is ever certain.

But if history rhymes—and it often does in crypto—Bitcoin may be stepping into its next phase of explosive growth.

Final Takeaway: The Early Bull Phase Is the Quietest Phase

By the time the general public realizes a bull run is happening, it’s often already too late to enter at the best prices.

The smartest traders pay attention to early indicators—before the noise begins.

Right now, Bitcoin is showing signs that something big is brewing. Whether you’re an investor, trader, or crypto enthusiast, this may be the moment to watch Bitcoin more closely than ever.