The post 71% of Institutions Say Bitcoin Is Undervalued Near $88,000: Coinbase Survey appeared first on Coinpedia Fintech News

Bitcoin price has been under pressure since October, dropping over 30% from its all-time high of $126,000. While the price drop has made many retail investors nervous, but a new data from Coinbase reveals a different story.

As 71% of institutional investors believe Bitcoin is undervalued near the $88,000 level.

Here’s what the Coinbase report says.

Institutional Investors See Bitcoin as Undervalued

According to Coinbase’s Charting Crypto Q1 2026 report, based on a survey conducted between early December 2025 and early January 2026.

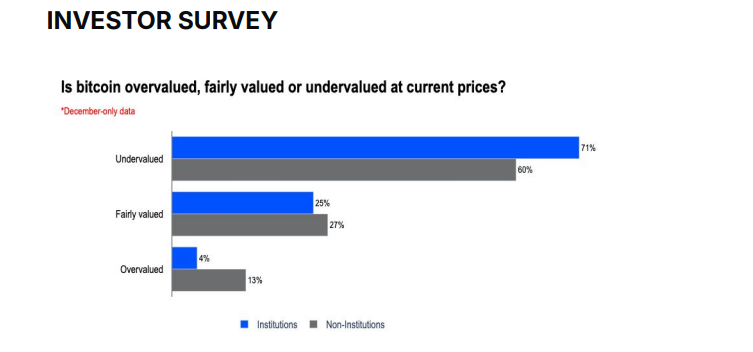

The survey included 75 institutional investors and 73 independent investors. Around 71% of institutions and 60% of independent investors said Bitcoin is undervalued when trading between $85,000 and $95,000, which is where the price stayed for most of the past two months.

Another 25% felt Bitcoin was fairly valued, while only a small 4% believed it was overvalued.

This data suggests strong conviction among major market players, even as Bitcoin trades near $87,800 today.

Institutions Continue to Hold and Buy

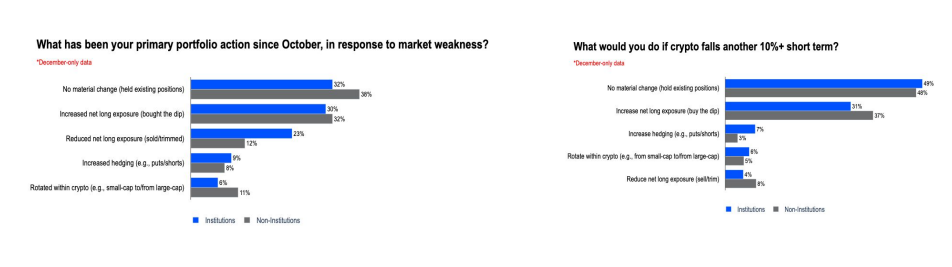

The report also shows that institutions are not just optimistic in words. More than 60% of institutional investors said they have either held onto their Bitcoin or increased their positions since the October peak.

Even more striking, 80% said they would continue to hold or buy more Bitcoin if the price drops another 10%.

Bitcoin ETF Outflows Tell a Different Story

Despite this long-term optimism, short-term data show a different story. Over the past five consecutive days, Bitcoin ETFs have recorded heavy outflows totaling nearly $1.7 billion.

Meanwhile, giant institutional investors like Fidelity and BlackRock led these withdrawals, with outflows of roughly $656 million and $537 million, respectively.

This suggests that while institutions like Bitcoin at current prices, some are reducing exposure through ETFs, possibly due to risk management or short-term market uncertainty.

Bitcoin Price Predictions for 2026

Looking ahead, several well-known figures remain bullish on Bitcoin’s long-term outlook. Arthur Hayes believes Bitcoin could climb above $200,000 if global liquidity increases, especially if central banks step back into money printing.

At the same time, author and economist Robert Kiyosaki has predicted Bitcoin could reach $250,000 by the end of 2026, citing fixed supply and rising institutional demand.

Even Cardano founder Charles Hoskinson has shared similar views, pointing to steady institutional adoption as a key driver.